UAE Tax Update Shakes Up Businesses – What It Means for You!

The startup scene, around the world is thriving now. Deciding on the best place to set up operations is a key choice for any business endeavour. India stands out with its consumer base of 1.S billion people and a remarkable achievement of 112 unicorns emerging from its soil. On the hand the UAE serves as a tax hub providing strategic connections to markets in the Middle East and Africa and beyond making it an attractive option for businesses aiming to go global. These nations present prospects, for startups looking to make their mark. This detailed comparison explores the intricacies of tax regulations, and market entry opportunities, in these vibrant locations aiding in your decision-making process, for the future success of your startup in 2025 and beyond.

Tax Environment

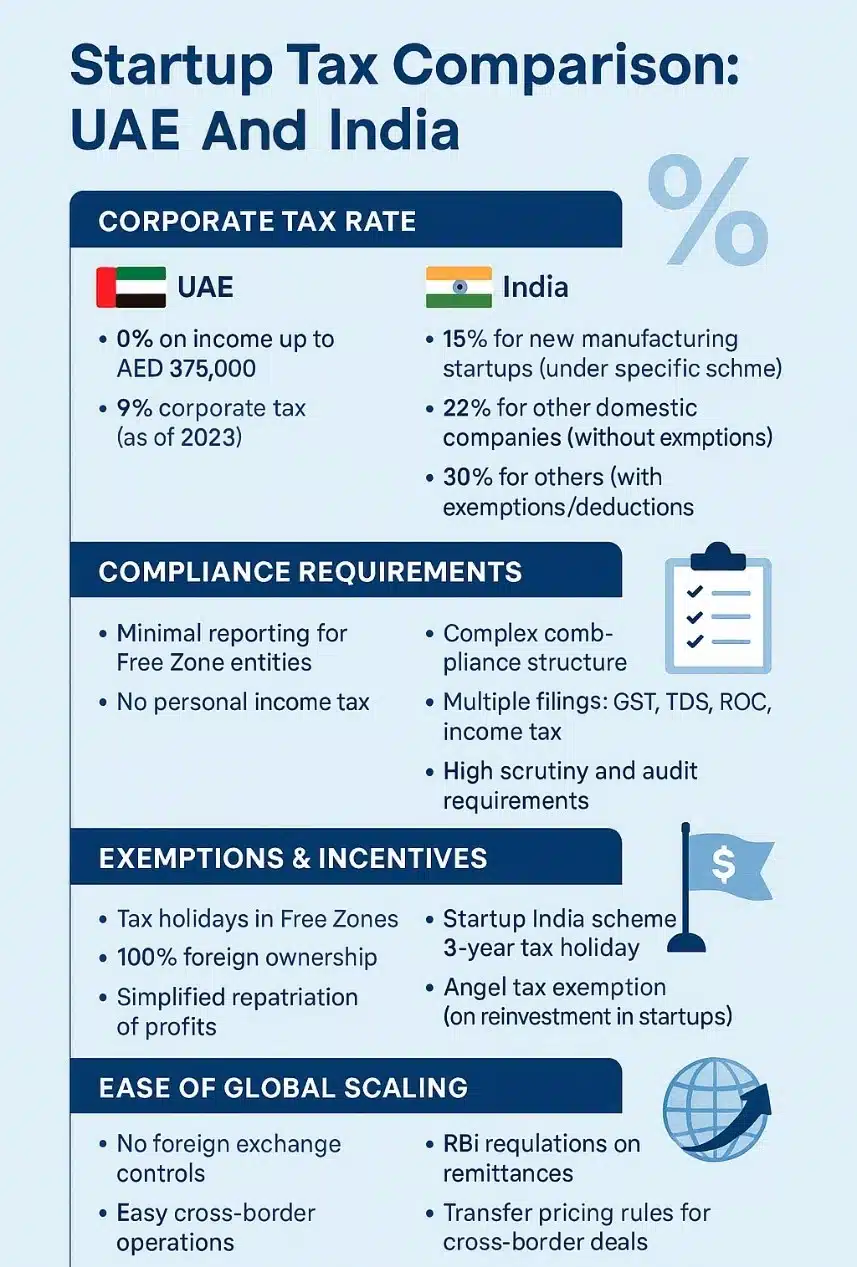

Tax Environment: A Comparative Look at Simplicity and Structure India’s Tax Framework

India’s tax system is multi-layered, featuring a Goods and Services Tax (GST) of up to 28%, corporate taxes typically ranging from 25-30% (with concessional rates for new manufacturing units), and detailed compliance requirements. Startups can benefit from a 3-year income tax holiday under the Startup India Initiative, though navigating bureaucratic processes can require careful attention.

UAE’s Tax Advantages

The UAE introduced a 9% federal corporate tax in 2023, applicable to profits exceeding AED 375,000 (approx. $102,000). A key attraction remains its Free Zones, such as the Dubai Multi Commodities Centre (DMCC), which continue to offer 0% corporate tax on qualifying income and 0% personal income tax, making the UAE a magnet for early-stage and internationally focused ventures.

Expert Insight:

“The UAE’s tax structure is notably startup-friendly, especially for businesses aiming for global scaling. India’s exemptions offer benefits but demand meticulous compliance,” says Arjun Mehta, CFO of Tech Buddy.

Startup Tax Comparison: UAE and India

- Consider adding a small note under India’s “30% for others” such as “(standard rate, varies with exemptions/turnover)”.

Funding Landscape: Exploring Volume and Strategic Access

India’s Thriving VC Ecosystem

In 2022 India received funding, for startups amount to about $25 billion with support from industry giants like Sequoia and SoftBank.The governments initiatives such as the Startup India Seed Fund offer grants.While funding slightly decreased to $7 billion in 2023 (as per Tracxn Geo Annual Report; India Tech 2023) aligning with patterns the inherent opportunities, in the market remain extensive.

UAE’s High-Net-Worth Backing and Strategic Growth

The UAE’s startup funding demonstrated strong growth, surging to $2.5 billion in 2023, driven by sovereign wealth funds (like Mubadala) and active angel investors. Programs like Dubai Future Accelerators not only provide funding but also pair startups with government contracts, offering unparalleled strategic access and growth opportunities.

Stat Alert:

- UAE startups have demonstrated a strong capacity to raise capital, with reports (e.g., Magnitt) often highlighting higher per capita funding compared to Indian counterparts, underscoring the concentrated investment focus.

Market Access: Scale and Strategic Positioning

India’s Billion-Strong Consumer Base

With a median age of 28 and a vast domestic market, India is an ideal landscape for tech, e-commerce, and fintech startups focused on scale. However, navigating fragmented regulations and infrastructure gaps can present challenges for nationwide scaling.

UAE’s Global Hub Advantage

The UAE serves as a strategic connector to the MENA region’s $1.6 trillion economy and places 80% of the world’s population within an 8-hour flight. Free zones offer benefits like 100% foreign ownership, and Dubai’s logistics infrastructure is ranked #1 regionally (World Bank), facilitating international trade and operations.

Case Studies:

- Flipkartleveraged India’s immense market depth to become a dominant force in e-commerce.

- Careemutilized the UAE’s connectivity and business-friendly environment to expand across 12 countries in the MENA region pre-acquisition.

Which Environment is Right for Your Startup?

- Consider India if your primary focus is a massive domestic consumer market, and your team is prepared to navigate its specific regulatory and compliance landscape.

- Consider the UAE if your priorities include tax efficiency, straightforward setup, access to international markets, and a globally-oriented business environment. The UAE excels in providing a streamlined pathway for global scaling.

Ready to launch or expand your venture? Let CrossLink.ae guide your UAE incorporation with expert advice and hassle-free processes, helping you leverage the UAE’s tax-efficient environment. Explore our services today.